Some mortgage programs and home loan types may have minimum credit score requirements.

When applying for a mortgage your credit score can play a big role in determining your interest rate and the loan programs available to you. Typically, the higher your credit score the lower your interest rate will be.

Click here to learn more about credit scores and buying a home.

If you’re looking for ways to improve your credit score, here are three options:

- Check your credit report and scan for any errors.

- Check your budget. Look at what’s coming in vs. what’s being spent. You can then cut costs in areas and put that money toward paying down debt, if necessary.

- Make payments on time, even if they’re the minimum amount.

Improving your credit score takes time, but I can help you find the right mortgage plan for you, even if you’re working on your credit.

Click here to learn more about credit scores and buying a home.

It's important to shop for homes that match your budget. Work with a Churchill Home Loan Specialist to help you to get your personalized Homeownership Plan.

If you want to see what your monthly mortgage payment means for your lifestyle, we recommend you give it a try first.

Think about your current rent or mortgage payment. If your new loan amount is going to be higher, put the difference into a savings account on the first of the month to simulate making your new mortgage payment.

Once you’ve test driven your estimated payment, ask yourself these questions:

- Am I able to make the payment work?

- Am I giving up anything to make the payment?

- Do I have enough money in your budget to enjoy my desired lifestyle?

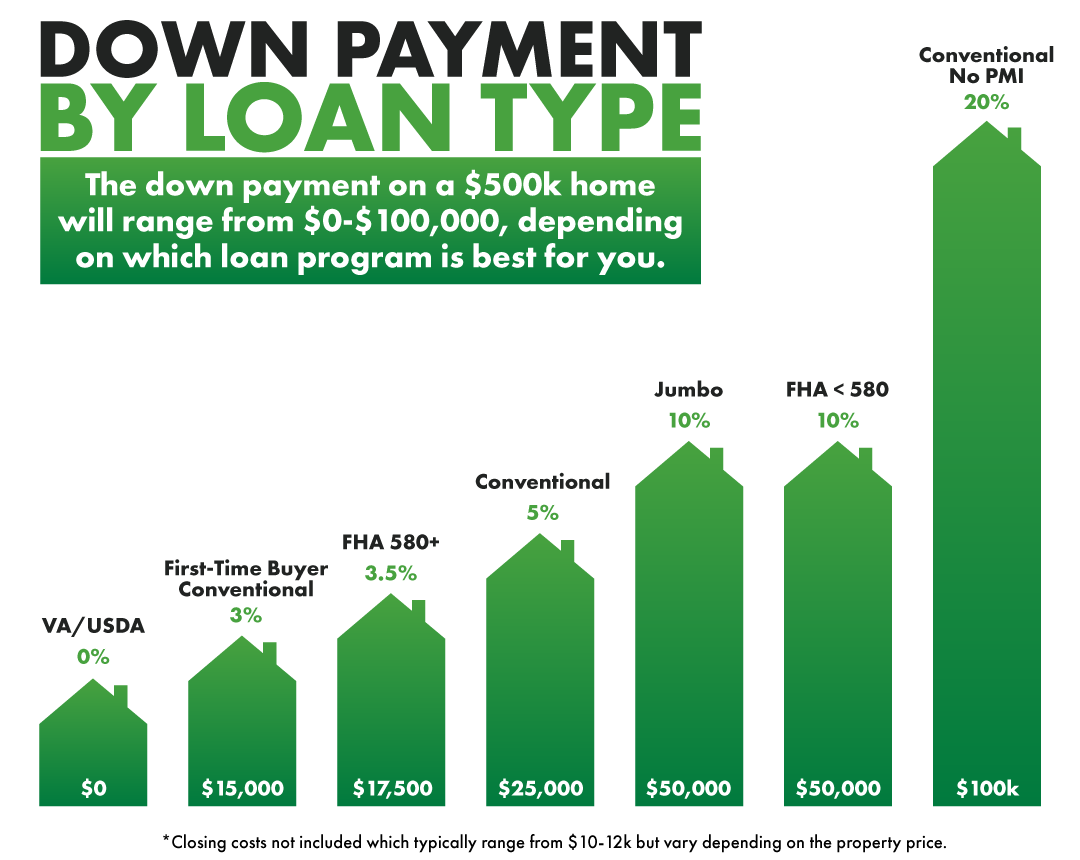

There may be a minimum down payment requirement depending on your loan program and type.

Not all down payments are created equal. In fact, they’ll vary based on your loan type. While 20% down is considered the ideal down payment, it is not necessary to start building equity through homeownership.

Many loan programs will require mortgage insurance if you do not put down a specific amount. For example, for conventional loans PMI is required if your down payment is less than 20%. And for FHA loans, MIP is required regardless of down payment amount.

Click here to learn more about down payments and buying a home.