Digital Mortgage Trends for 2021

< Back to Articles | Time to Read: 5 minutes

Technology has paved the way for convenience, knowledge, and value. Traditionally, many aspects of the mortgage process have taken place in person: interior home appraisals, securing a notarization, and signing closing documents. Times have changed and the need for interactive online tools have become a necessity in the housing market instead of a “nice to have.”

During the home buying process, technology will help you:

✔ Save time and money during the home search process

✔ Gain an accurate sense of what a home looks like both inside and outside

✔ Better understand the full value of a property

✔ Have more insight into your home loan

Digital Mortgage Solutions

Digital Mortgage Solutions

A mortgage is more than likely the largest financial transaction you will make in your lifetime. Because of that, there are a lot of moving pieces in the process. As time goes on, the lending industry has become more and more high-tech to eliminate as much stress as possible when getting a home. The digitalization of mortgages continues to reduce the amount of time it takes to get a home loan from start to finish, and offers you greater flexibility and convenience.

The Churchill Mortgage App

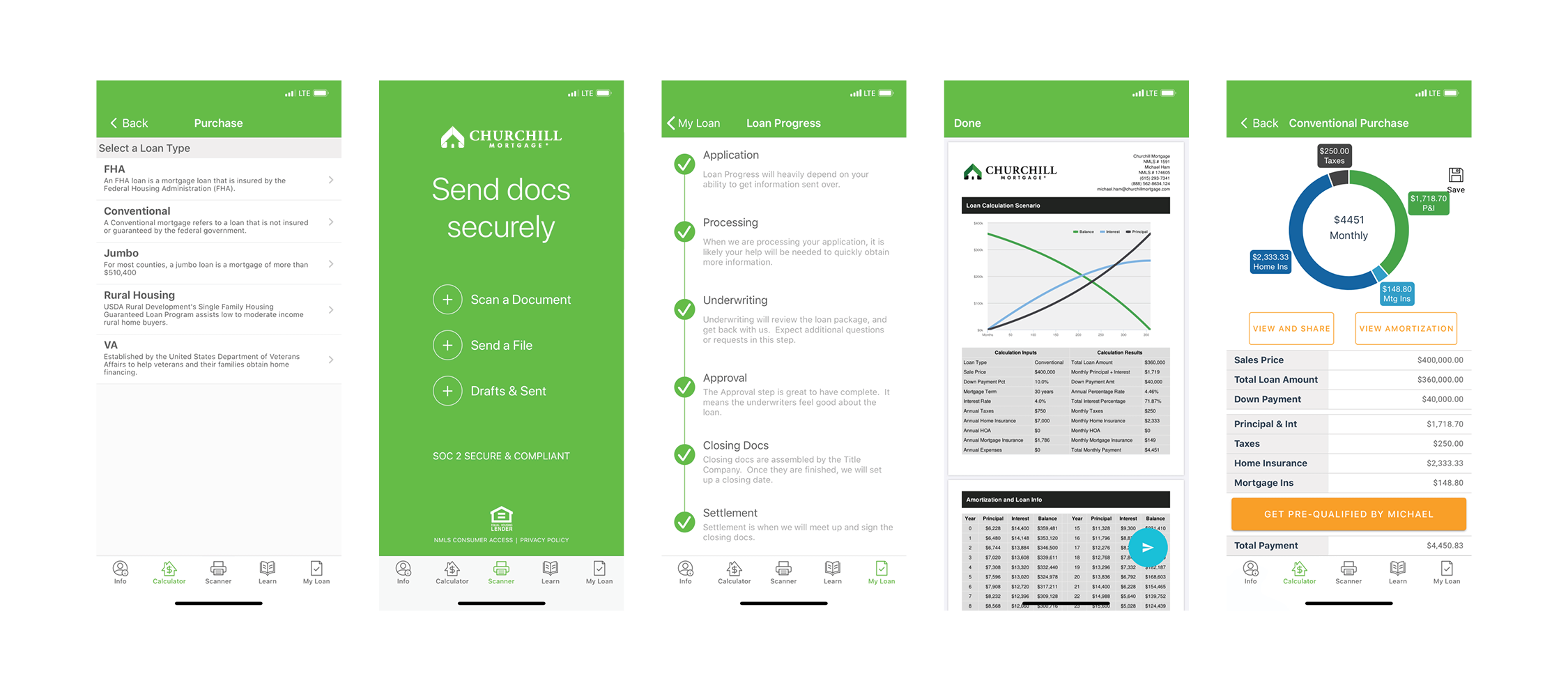

By taking advantage of the Churchill Mortgage app during your home loan process, you can engage when you want, how you want, and where you want.

•Upload key documents securely anytime, anywhere

•Stay connected to your home loan team

•Monitor your progress, every step of the way

The Churchill Mortgage app is easy to navigate, and keeps you organized and on-track as your loan progresses through various milestones (application, processing, underwriting, approval,

The Churchill Mortgage app is easy to navigate, and keeps you organized and on-track as your loan progresses through various milestones (application, processing, underwriting, approval,

and closing). Bottom line: It is a quick and easy resource you can use when you need to access anything related to your home loan.

Home Appraisals Re-engineered

When you apply for a mortgage, your lender will typically require the property you are purchasing to be appraised. This will give you an estimate of how much a home is worth in today’s real

estate market.

A common misconception about property appraisals are that the appraisal amount is only for the house itself. In fact, the appraisal is for the total value of the home (and any other permanent structures on the property) in addition to the land the home is built on. Because of this, an appraiser will need to look at both the outside and inside of the home. This combined value will help determine the loan amount you can get from your lender to buy the property. A low appraisal can ruin the sale of a home!

Quick Tip: The Home Valuation Code of Conduct (HVCC) went into effect in May 2009 and prohibits lenders from having direct contact with appraisers. As a result, most lenders today work with a third-party appraisal company within the geographic area of the home being appraised.

Keep in mind, home appraisals are a little trickier when not done in person since they are very detailed. But it can be done. Through the years, companies have developed ways to transform the remote appraisal process. Most recently we have seen a lot of “drive-by” appraisals where the appraiser will look outside at the property, peer in windows, and rely on inside pictures taken by the real estate agent or the home seller.

Convenient Home Closings

More than likely you will have to show up on closing day to sign some papers, but that does not mean everything is old school. The days of in-person home closings are becoming few and far between in today’s digital age.

Most lenders now provide a hybrid closing which means you electronically sign some documents online through an e-closing process, and final documents (that must be notarized) will then be signed in person. With less documents to sign in person, the hybrid

closing process is much quicker than traditional closings of the past.

Some states are even allowing entirely remote closings (where all parties sign electronically). The COVID-19 pandemic paved the way for a more digitalized closing experience for all U.S. states in the future. Each lender, title company, and state (and sometimes counties within the state) have different requirements for this type of closing so ask questions as you move along in your home loan process.

Even with this added technology, we are finding most home buyers still want some human interaction and consultation when navigating closing documents for a mortgage. No matter where you are, or what type of home you are looking for, there are technologies in place to guide you every step of the way.