Filing Your 2021 Taxes: What You Need to Know

< Back to Articles | Time to Read: 5 minutes

2021 brought with it a unique set of challenges, changes, and opportunities. As we enter tax season, we want to make sure you’re prepared. Here’s what you need to know before you file.

Dates to Know:

- Filing Deadline: Filing can take place from January 24 through April 18,

- Extension Deadline: Make sure you file for an extension by April 19, 2022. Remember, if you ask for an extension, you must file by October 17, 2022.

Refunds:

While there’s no guarantee when your refund will come through, the IRS says that filing electronically and choosing direct deposit as your payment method may speed up the process. If you received Earned Income Tax Credit or Additional Child Tax Credit, the law states your refund cannot be processed until at least the middle of February.

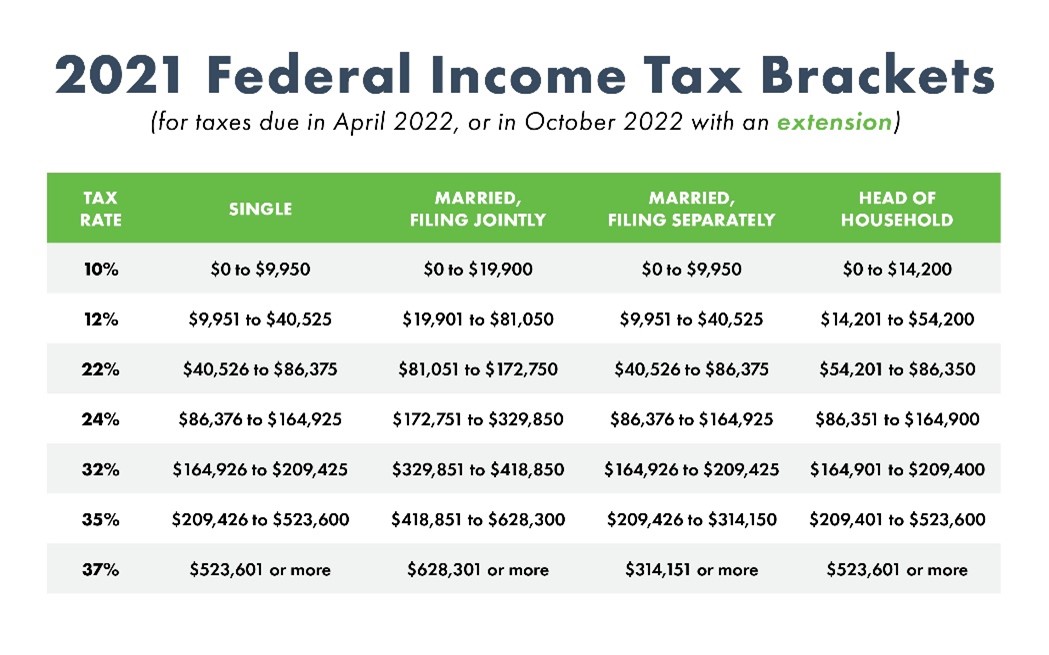

2021 Tax Brackets:

According to the IRS, the highest tax rate will be 37% for individual single taxpayers whose income is above $523,600. For married couples who file together, this number will go up to $628,300. If you’re married but filing separately, it will be $314,151. Finally, the Head of Household will be taxed 37% at an income of $523,600.

Due to inflation, the cost of everyday items has grown more expensive, increasing the cost of living. The IRS works with the overall cost of living and adjusts tax brackets to reflect what that looks like for individuals and families alike.

Due to inflation, the cost of everyday items has grown more expensive, increasing the cost of living. The IRS works with the overall cost of living and adjusts tax brackets to reflect what that looks like for individuals and families alike.

2021 Deductions:

- Standard: Remember that a standard deduction is one where you have not made any itemized deductions and are just working with the part of your income that is non-taxable. For 2021, this will be $12,500 for single filers and $25,100 for married couples filing together. These numbers are slightly increased from 2020, where single taxpayers saw a standard deduction of $12,400 and married joint filers were at $24,800.

- Itemized: Itemizing your deductions takes more time and effort but may be beneficial if you end up with what more than a standard deduction will give you. If you aren’t sure what’s best for you, we recommend reaching out to a tax professional to help you decide.

If you do want to itemize your deductions, here are some things you may be able to add to that list:

- Health insurance

- Mortgage interest

- Medical bills

- Student loan interest

- Educational bills (such as tuition)

- Donations to charities and non-profits

- State taxes

- Local taxes

- Home improvement (energy saving)

- Electric car credit

- Business expenses

- HSA (Health Savings Account) contributions

It’s important to note this is a condensed list and that there will be limits from the IRS on any itemized deductions. As we stated above, the best bet is to speak to an accountant or tax professional with any concerns.

Pandemic Programs that May Impact Your Taxes:

- Unemployment Benefits: Unemployment income is subject to taxes and needs to be reported in your 2021 income tax return. Many people still received Pandemic Unemployment Assistance in 2021 due to the coronavirus and may be looking at smaller refunds (or taxes owed) if taxes were not withheld from those payments.

- Stimulus Checks: If you received Economic Income Payments (stimulus checks) you will want to review the Recovery Rebate Credit guidelines issued by the IRS. If you received the maximum amount allowed by the government, you do not need to include any information about your payments when you file your taxes. However, if you didn’t receive a payment or only received a partial payment, you may be eligible to claim the Recovery Rebate Credit when you file your 2021 tax return.

- Child Tax Care Credit: Millions of families received a Child Tax Care Credit in 2021. Many people were given a credit of $3,000-$3,600 per child depending on age, with half of that money being paid out monthly from June 2021 through beginning of January 2022. This is fully refundable on taxes for families who were part of the program.

No matter if you’re single, married, taking a standard deduction, or itemizing, making sure your taxes are correct is crucial. When in doubt, hire a professional, it just may help you get more out of your tax return this year!

Please remember this is just a guideline and Churchill Mortgage does not give any tax advice. Now, if you’re hoping to buy or refinance in 2022 and are looking for home loan advice, that we can give! Click here to connect with a Home Loan Specialist.