Understanding Home Equity: How It Works and How to Calculate It

< Back to Articles | Time to Read: 5 minutes

To become a home buying powerhouse, you need to know about equity. Home equity is the amount of interest a home has built over time. Your equity can increase over time if the property value increases or if you pay down your mortgage loan balance.

The Importance of Equity for First-Time Home Buyers:

As a first-time home buyer, one of the ways you can help ensure a boost in equity is by finding ways to add value to the home you purchase. This can include upgrades or renovations, finding ways to pay down your mortgage principal, or living in an area with rising property values!

Make sure you take advantage of all the resources available to help you during the house hunting process, including up-to-date search listings in the Homebot app, your Realtor®, and your Home Loan Specialist. Your Homebot app will also offer a monthly home digest that shows how much equity you've built up.

DON'T FORGET!: Mortgage principal is the outstanding balance of your mortgage. As monthly mortgage payments are made, the mortgage principal is reduced.

Why Equity Matters When Upsizing from Your Current Home

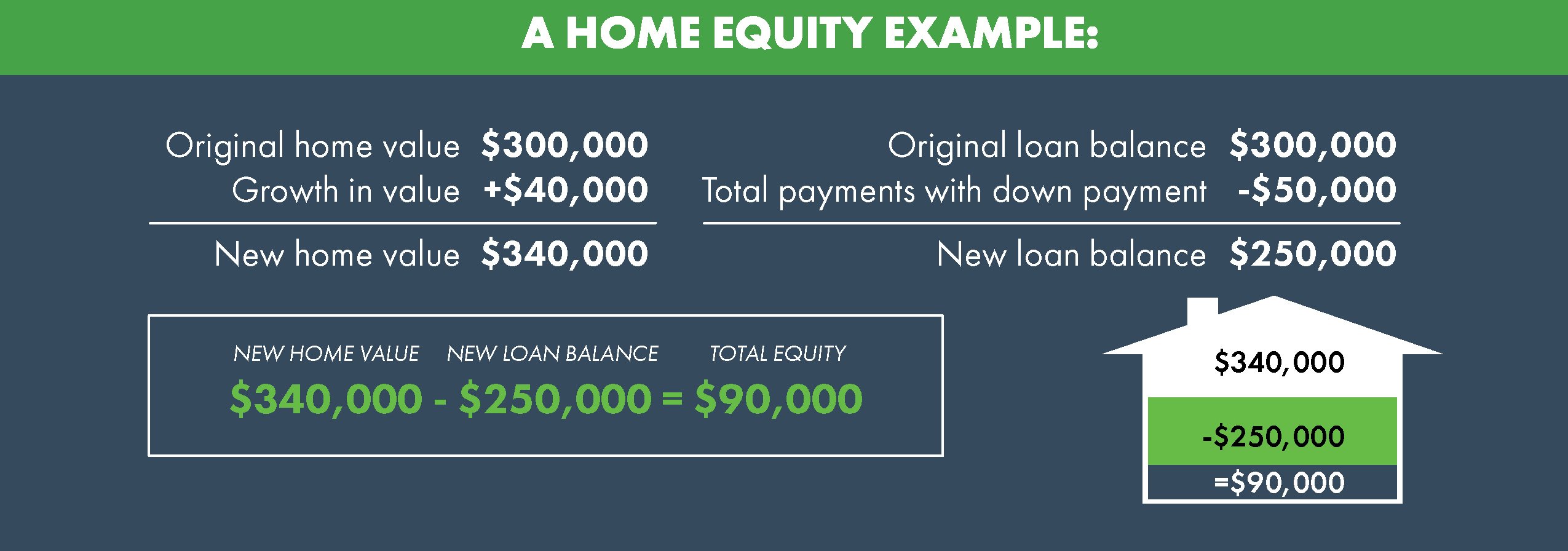

If you’re a homeowner looking for more space, figuring out how much equity you’ve built up in your home is easy. To get started, you'll need to know your home's current value, which can be determined through an appraisal, and the remaining balance on your mortgage. Once you have this information, you just subtract the amount you owe on your mortgage from the value of your home. The remainder is your home equity which helps you gain momentum for your next home purchase.

How Equity Helps You Build Wealth

Equity in your home is a powerful tool for building wealth over time. As you pay down your mortgage and your property value increases, you gain more ownership, which boosts your equity. This growing equity can be leveraged for future investments, home improvements, or even used to fund other financial goals. By building equity, you’re not just paying off a loan – you’re growing your financial foundation.

You may be a long way from retiring, but it helps to think of buying a home as a long-term investment. Even with property taxes, insurance, and upkeep, it’s likely you’ll pay less than you would if you were to rent. And if you can pay off your home before you retire, you can always downsize and pocket the extra cash.

So, the real question now comes down to—how much house can you really afford?

Once you have your budget pinned down, you need to figure out how much money you will put toward your down payment. The more cash you put down up front, the lower your monthly mortgage payment will be and the quicker you’ll pay off your home loan. If you put down 20% or more (of the home’s price) you will avoid paying Private Mortgage Insurance (PMI) with a conventional loan. PMI typically costs about 1% of the total loan value.

FUN FACT!: Nearly 70% of all new home sales were financed using conventional loans in 2020. This type of home loan is not insured or guaranteed by a government entity (like an FHA loan) but is backed by private lenders. *