Market Watch: September 2018

< Back to Articles | Time to Read: 5 minutes

While much of 2018 has been an up and down roller coaster with interest rates, we know the overall long-term trend with mortgage interest rates is for rates to move higher. The summer months were fairly calm with rates slowly moving up and down a small amount. But that gentle up and down trend stopped at the beginning of September. Rates seem to be rapidly rising and have so far reached their highest levels of 2018. The primary reason for this is the strong economy.

At a very simple level, bad economic news brings lower rates and good economic news brings higher rates. We see this in very small ways day to day. For example, the president will announce big tariffs, worldly concerns, or news that appears bad for America economically, and rates improve a little. But when we have a low unemployment rates, the mortgage interest rates seem to get a little worse. Here’s the big picture: there’s no denying the American economy is doing extremely well right now.

There are a couple of pieces of data that help us track what rates are doing. For the consumer, like you, the most readily available is the 10-year treasury. While not directly tied to mortgage rates, it’s a good predictor. As treasury yields go higher, mortgage rates will likely go higher. Let’s look at the 10-year treasury yield from August 24, 2018—it was down around 2.81. A few weeks later on September 19, it reached 3.08 and appears to be heading higher.*

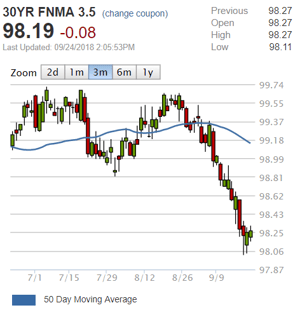

The second piece of data to look at is Mortgage Back Securities. This would most directly reflect mortgage rates. There are two important things to know when looking at this chart:

- Red is bad and green is good.**

- The lower the price goes, the higher rates are going.

As described earlier, you can see the subtle up and down fluctuations throughout the summer, then you’ll see the more rapid drop in security prices over the last 4 weeks.

We can’t predict the future, but this does give you a sense of what is happening in the market. If you’re under contract or about to go under contract and ready to lock your rate, one option that is always available is to “float” your rate. There is certainly a risk in doing this as pricing could just continue to get worse but there’s also a good possibility that we will hit some sort of bottom and have some degree of bounce back. It just depends on market conditions and day-to-day reports and world news.

It’s important to keep things in perspective: A change of rate of 0.125% is often only a $10-$20 change in your monthly payment. And if you have a long-term perspective on interest rates, they are still historically low and reasonably good!

If you’re going under contract and ready to look at locking, we’re here to discuss rates and options. If you’re still searching for a home, just be aware of the rate movements. And as always, reach out to us with any questions you may have!

Resources: *CNBC.com ** Mortgage News Daily: http://www.mortgagenewsdaily.com/mbs/

Written by: Joshua Phillips, Branch Manager of The Phillips Team at Churchill Mortgage.