There's no getting around the fact that credit matters when it comes to getting a home loan. So, it's important to know what you need to do to get the credit score you want so you're able to buy a home on your terms.

People ask us all the time if a credit score really matters. In short, yes. The longer answer is, it depends. Some people have paid off all of their debt which gives them a credit score of zero (0). But, if you do have a credit score and it's in the "very good" to "excellent" FICO® range (740-850), you will have access to better interest rates, lower payments, and more buying power.

The main determination for a credit score comes from a widely-used credit scoring framework – FICO® and Vanguard. They get reports from the three credit bureaus:

- Experian

- Equifax

- TransUnion

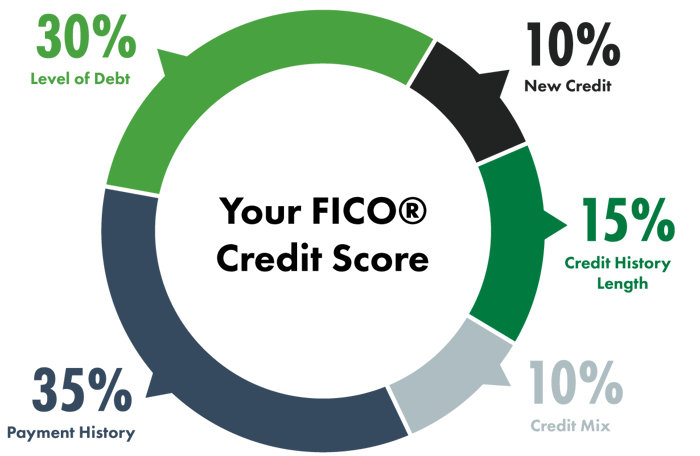

These reports create your credit "worthiness" based on both your credit usage history and payment history.

There are many nuances when it comes to credit scores.

A zero credit score, means you are "credit invisible" and have paid off all your debt, or you if you’ve never had debt to begin with—so no credit cards, car payments, or any type of loan that would cause a high or low credit score.

A low credit score doesn't always mean you haven't paid your bills on time. It could mean you're still building up credit or you aren't using credit often enough to impact your score.

If you have low credit and are looking to buy a home the best thing to do is:

- Work on becoming debt free by paying all your outstanding bills to get your credit score down to zero.

- Or try to build additional credit to raise your credit score so you can qualify for an FHA or Conventional home loan in the future.

Credit is a little word that packs a big punch for most people, especially when you're buying a home. Understanding credit and how it works can be overwhelming. So, let's try and simplify it! We're here to break down what you need to know about credit and how it can impact you as a home buyer.