Down Payments & Buying a Home

Homeownership is one of the best investments you can make on the path to long-term wealth. Your down payment is a great way to set yourself up for success.

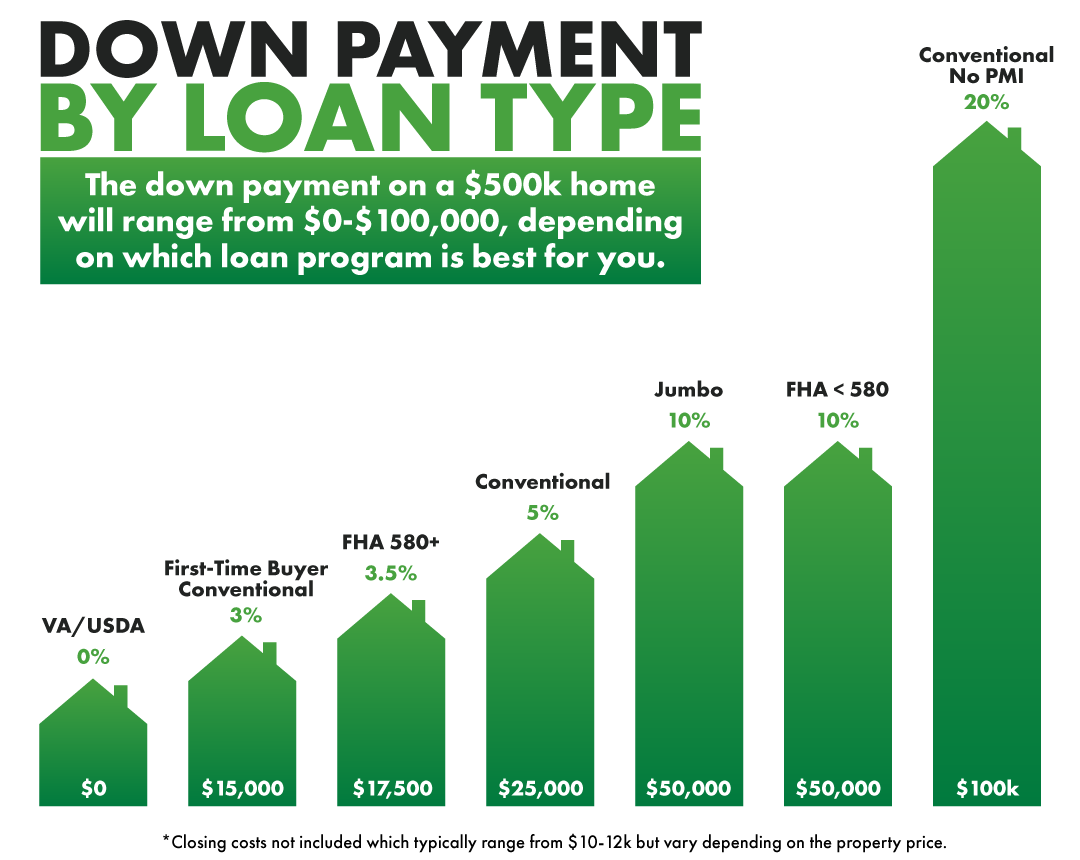

Ever wonder how much money you really need for a down payment and why it's so important when you buy a home? To put it simply, your down payment allows you to pay less interest and can help you build long-term wealth.

A down payment is helpful for a couple of reasons:

✔️It allows you to lessen the amount you must borrow to buy the home, allowing

you to pay off your mortgage faster and with smaller payments, often at better

interest rates.

✔️The discipline required to save up for a down payment is helpful once you own

the home, keeping you steadfast in budgeting.

Down payment assistance comes in many forms and usually vary state-by-state. Some down payment assistance programs have certain requirements such as being a first-time home buyer, falling into a specific income bracket, or having a certain credit score to apply.

These programs can be beneficial, but only if you know exactly what you’re signing up for, and how much it may cost you financially in the long run.

Options for down payment assistance programs can be found on your state government pages, as well as on the federal page for U.S. Department of Housing and Urban Development. There are even options from the city and county level.

A down payment of at least 20% is ideal, but not a deal breaker if you have less than that.

When 20% down is not an option:

✔️ Speak with your Home Loan Specialist to help you come up with a plan for what IS possible.

✔️ Your range may be more along the lines of 10-15% (or less) and that’s ok!

✔️ If your down payment is less than 20% mortgage insurance may be required.