How Interest Rates and Inflation Affect Home Buyers

< Back to Articles | Time to Read: 5 minutes

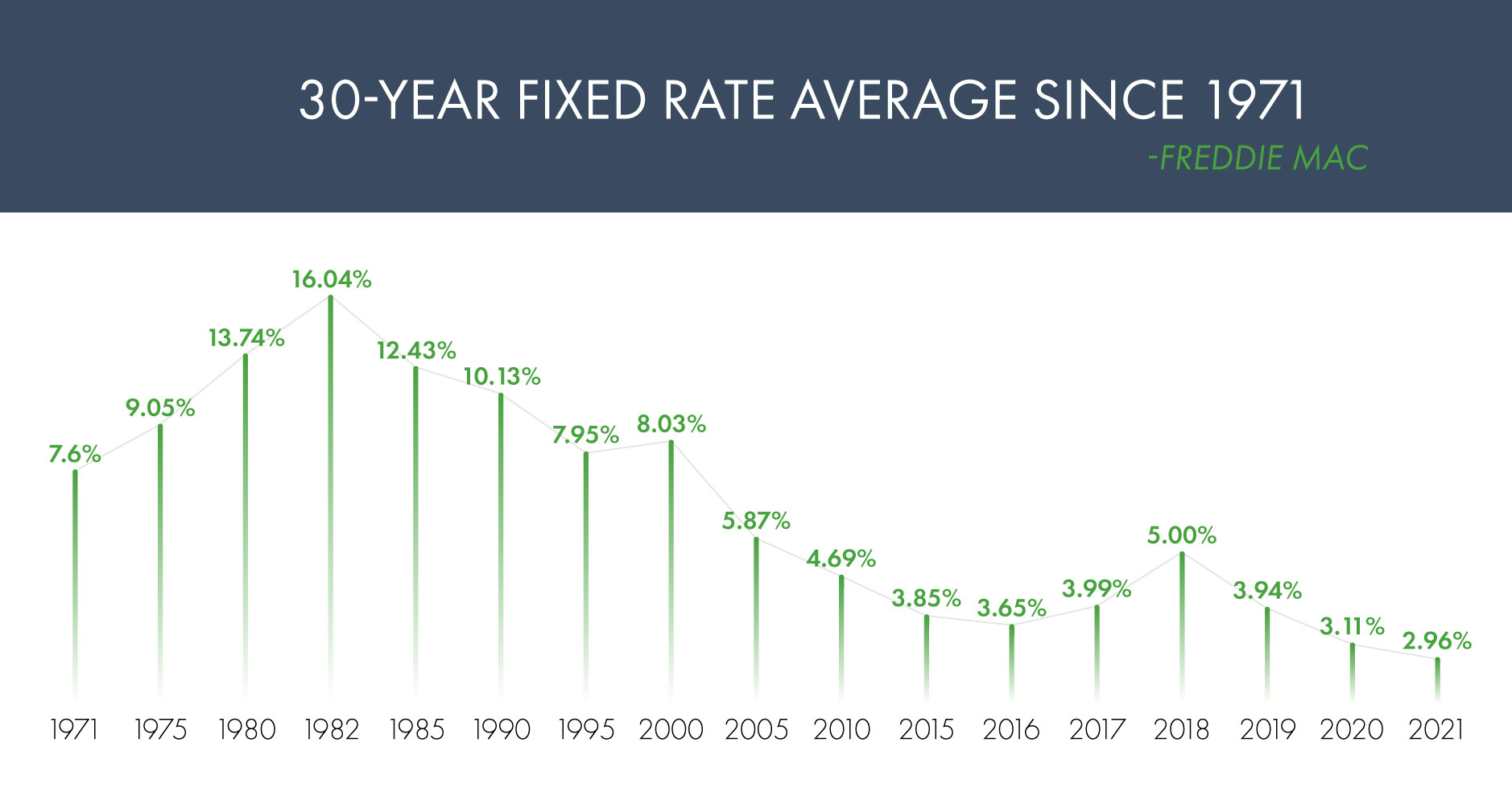

We understand why the potential of rising interest rates would make you nervous when buying a home. After all, who wants to pay more on an already huge purchase? The truth is interest rates are still low and well below average when we look at the history of interest rates.

As you can see from the graph below, interest rates have always fluctuated, and in some years, have been notoriously higher than they are right now. In fact, it’s almost as if mortgages are having a half-price sale when compared to decades past.

The reason rates were so low the past two years was to offset the economic issues of the Covid-19 pandemic. The Federal Reserve made the decision to lower rates to keep not only America, but the world’s economy, healthy. While rising rates are never what a home buyer wants to see, they do help balance out the economy.

The reason rates were so low the past two years was to offset the economic issues of the Covid-19 pandemic. The Federal Reserve made the decision to lower rates to keep not only America, but the world’s economy, healthy. While rising rates are never what a home buyer wants to see, they do help balance out the economy.

This improving economy is also a reason to not worry (too much) about inflation when buying a home in 2022. Inflation is high for many reasons including world events and supply issues. There is a positive to all of this, though. Since a lot of this inflation is manmade due to lack of inventory (think lumber shortage), prices should start to even out as time goes on and there is less of a shortage issue.

What does this mean for people looking to buy a home in 2022?

While inflation isn’t expected to stay as high as it is now, home buyers will need to have patience. Why? Because the one thing that isn’t changing too soon is the real estate market. Tom Gillen, Senior Vice President of Capital Markets here at Churchill Mortgage, was recently quoted in NerdWallet, stating “the biggest issue that we’ve got in the real estate industry today has nothing to do with increasing interest rates, it has to do with lack of supply.”

So, what can you do to increase your odds of buying your new home right now?

First off, it helps to know what’s on your wish list and what you’re willing to sacrifice. Does it make more sense to have a shorter commute but a smaller yard? Would you rather have an extra bedroom instead of a bigger kitchen? These decisions will help you narrow down your home search and move quickly in this seller’s market.

.jpg?width=765&name=iStock-1281607835%20(1).jpg)

You’ll also want to sit down and go over your budget. Knowing what is being spent each month and where you can cut back to put more toward your new home will go a long way when buying.

Then, you'll want to take advantage of Home Buyer Edge. This exclusive program offers buyers the competitive advantage needed in today's real estate market. Here's a quick recap of what Home Buyer Edge offers:

- Lightning-fast Pre-Approval

- Home Buyer Consultation

- Certified Home Buyer and Rate Secured

- A Trusted Advocate

- $5,000 Seller Guarantee

After your Home Loan Specialist walks you through your Home Buyer Consultation, you’ll want to cap your interest rate. Rate Secured allows you to cap your interest rate for 90 days while you find your new home! You can also reset this rate for an additional 90 days if you haven’t found a home you want to buy yet. The best part is if rates go down, you get the lower rate, but if rates go up, yours doesn’t change!

After your Home Loan Specialist walks you through your Home Buyer Consultation, you’ll want to cap your interest rate. Rate Secured allows you to cap your interest rate for 90 days while you find your new home! You can also reset this rate for an additional 90 days if you haven’t found a home you want to buy yet. The best part is if rates go down, you get the lower rate, but if rates go up, yours doesn’t change!

Once you’ve locked in your rate and found your home, you’ll want to make sure your offer stands out. The best way to do this is by becoming a Churchill Certified Home Buyer. This is considered the gold standard of pre-approvals and sets you up almost like a cash buyer. Not only will your offer look more attractive to a seller, especially during a bidding war, but many clients are finding that they’re closing on their homes more quickly.

Here at Churchill, we understand the anxiety that comes with hearing about rising interest rates and inflation, but we also know it’s still a great time to pursue homeownership. Our team of experts are here to help you find the smartest mortgage plan for you, no matter the current housing market or interest rate.

If you’re ready to buy your new home or have any questions at all, reach out to one of our Home Loan Specialists today!